Tis' the Season to be Wary (of Tax Scams)

Ah, tax season. Unlike thoughts of hot chocolate, sleigh rides and jingle bells it's rather the ho-hum season of filing and payments to Uncle Sam. Though for some, the idea of a tax refund is promising, for scammers it's the perfect season of opportunity. Many may be familiar with the call that threatens to send police to your home if you don't pay the IRS immediately on the phone but unfortunately scammers have many methods as varied as presents under a holiday tree.

While it’s easy to think ‘I’d never fall for such an obvious scam’ the fact of the matter is enough people do on a yearly basis so as to make it lucrative for criminals. And given such scams are only seeing an increase by the IRS and other agencies means it’s not going anywhere anytime soon. According to Trend Micro, within the first three months of 2022, the cybersecurity company already detected more than 135,000 fake websites designed to either pose as government sites or as trusted tax preparation providers or advocates.

While a threatening call might be easy enough for you or I to identify and hang up on, there's quite a few different approaches in an attempt to swindle hard-working tax payers out of a refund or defraud posing as a legitimate tax preparer.

What are some of the common ruses used in tax scams?

Impersonating IRS Representatives Scam

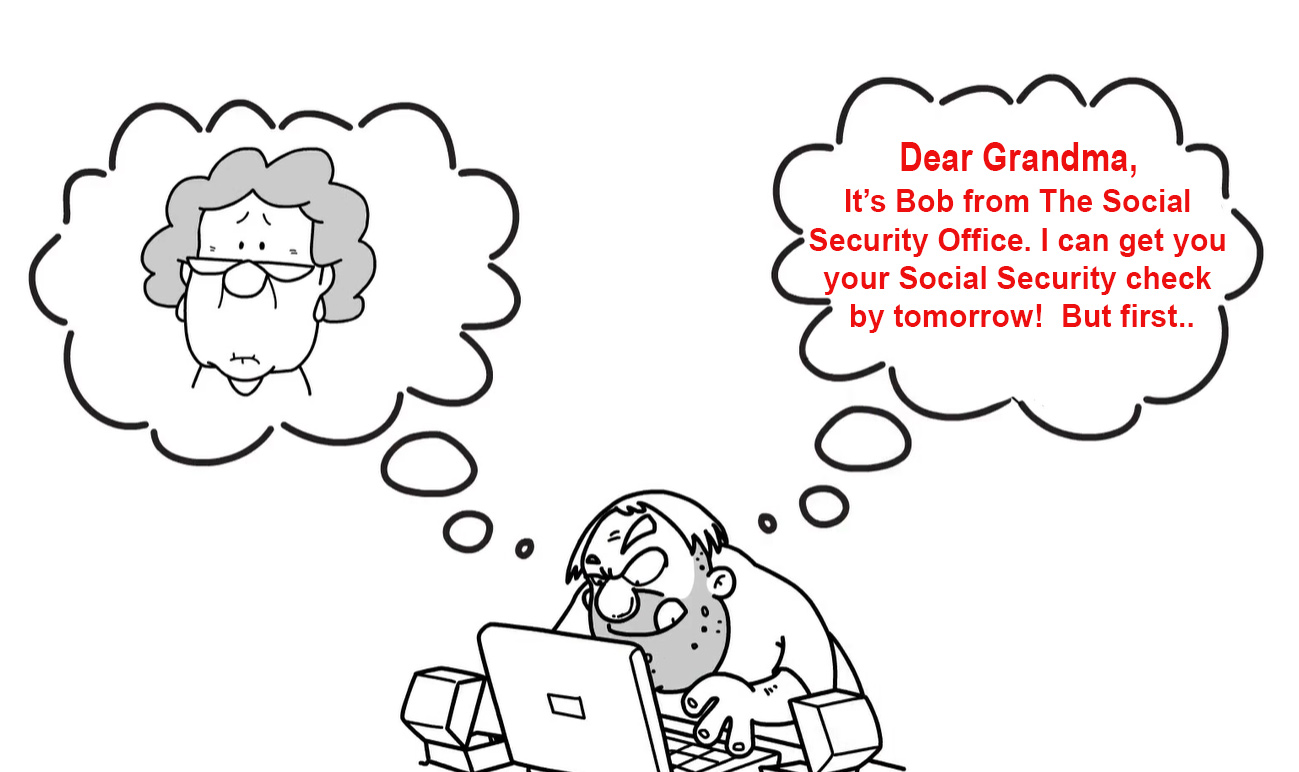

Whether the phishing attack comes through an email, text message or a phone call, the scammer pretends to be a representative from the IRS department and usually there is supposedly a problem of some sort with your taxes - you’re overdue, there’s extra fees, etc. These types of scams pressure you to take action now or face dire consequences such as having authorities sent to your home or be carted off to jail. To avoid all this, they encourage, you will be directed to pay the debt owed through gift cards, pre-paid card, wire transfer, cryptocurrency. Some instances may state they ‘require’ your bank information to ‘verify’ your identity. What’s really happening is they are looking to steal your personal and/or financial information or to get a quick payout.

Online Ads for Tax Preparation or other Tax Help

Typically, these sites run ads that direct unsuspecting users to either fake versions of legitimate websites or are simply posing as legitimate service providers to assist you with filing taxes. These sites ask for identifying information and once given over they can continue to perform various forms of identity fraud and theft. Some sites may even install malware onto your computer that gives them further access into any online info you submit or have saved.

In short, any variation - regardless if via a text (SMS), email or phone call - scammers are intent on getting your social security number, payment info and other personal details. Once they have it they can either submit a fake tax return in your name, sell the information on the dark web or perform other forms of identity theft.

But there are other variations that may be a little more sneaky.

Offer in Compromise ‘Assistance’

Offer in Compromise (OIC) is a real option with the IRS that is an agreement between it and a qualifying individual who is not able to pay their tax debt. The OIC essentially agrees that the IRS will accept less than full payment under certain conditions.

Scammers abuse this offer by advertising their assistance to help settle a debt with the IRS at “pennies on the dollar” while taking a high upfront fee. Alternatively, they provide misleading advice to taxpayers to file an OIC application knowing they won’t qualify.

Tax Preparer Fraud (aka Ghost Tax Preparers)

There are many an honest and hardworking tax preparers out there. When a professional tax preparer completes and submits documentation on your behalf, they are required to sign the documents themselves along with an identifying number (Preparer Tax ID Number, or PTIN). However, fraudulent professionals complete the forms and omit signing the return making you solely liable while typically they direct the funds to themselves and not to your account.

If a service provider or professional offers you a deal - be it online, from a flier or in-person - if the deal offered sounds too good to be true, stop! Question what the motives are and consider the information they are requesting in return. What your momma told you holds true in taxes as well, there's no such thing as a free lunch.

Facts to educate ourselves (and our loved ones)

The IRS will not:

-

Leave threatening messages on any answering system.

-

Immediately send local law enforcement to your home for not paying.

-

Demand payment via prepaid debit card, gift cards or wire transfers or ask for checks to third parties.

-

Demand payment without giving an opportunity to question or appeal.

Create an Identity Protection Pin (IP PIN)

An IP PIN is offered by the IRS to add another layer of protection that you use each year when you send in your returns. This prevents scammers from filing a return in your name. Set it up here: https://irs.gov/ippin.

Official Tax Preparers have a Preparer Tax ID Number (PTIN)

You can verify the PTIN with the official IRS directory. This will ensure you’re using an individual who has been approved and furthermore, the directory displays the varying level of education and expertise so you can best find one that meets your needs.

Verify any claims of taxes owed on IRS.GOV

Check your personal tax account information directly at https://www.irs.gov/payments/your-online-account to see if you owe any taxes as well as review payment options here as well.

Also, be sure your IRS account is secured with a strong password that you don’t reuse for any other accounts and enable the multi-factor authentication to add an extra layer of protection to your account.

It’s easy to create a strong password with the tips in the video below:

Real IRS bills are initially sent via the postal service

Typically, when there is a bill owed to the IRS, an initial bill will be mailed to the individual (not through phone, email or text) and only the approved ways to pay should be followed according to the IRS.gov website - which include payment plans and filing for extensions.

A few more resources and tips:

For OIC there is an official online tool to check if you indeed qualify for an OIC. Also, the IRS reminds that most actions needed regarding tax debt may be resolved by an individual directly themselves through contacting the IRS on its official site.

Non-native English speakers may request which language they wish to communicate with the IRS and all future info will be in that selected language through submitting a Schedule LEP. Currently, some IRS information is also available in Spanish, Chinese (simplified and traditional), Vietnamese, Korean and Russian.

Senior Citizens born before Jan 2, 1956 may complete the Form 1040 in a new and simplified Form 1040-SR. As senior citizens are among the most targeted populations for scams such as these, it’s important to ensure they are aware of some of the most common scams that target them.

When it comes to tax season, while it may not invoke anyone to be jolly, we can have peace of mind through increased awareness of how to keep ourselves and our loved ones safer.

Ayelet HaShachar Penrod

A passionate security awareness advocate, I connect and support security professionals as a Community Manager while also managing customer accounts for **Wizer Managed**, our security awareness service. Driven by 4 years of learning from cybersecurity experts, I’m committed to making security awareness accessible to all—individuals, small businesses, nonprofits, and enterprises alike.